Take control of your money, one chat at a time

Personal finance advisory that listens, tracks, and plans with you.

How we help you take control of your money

Nobias is a female-founded platform on a mission to make money advice accessible, trustworthy, and to close India’s financial clarity gap

0 Commissions

|

100% Unbiased

|

1:1 real conversations

|

0 Commissions | 100% Unbiased | 1:1 real conversations |

Meet your certified financial guide

Lara Menezes, CA, CFP

Lara Menezes brings more than two decades of financial leadership to Nobias. A Chartered Accountant certified by the Institute of Chartered Accountants of India, she has worked with global firms like Deloitte and Pliva before launching and scaling her ventures for over 12 years. Born and raised in Goa, Lara blends corporate rigour with entrepreneurial agility, offering a rare mix of structure and vision.

Gaurav Janmali, CFP

With over 8 years of experience in personal finance, Gaurav Janmali is a Certified Financial Planner (CFP®) known for building tailored, goal-oriented financial strategies. A graduate of Pune University with a B.Com, he specializes in retirement planning, investment management, and tax optimization.

Gaurav’s client-first mindset and analytical depth have helped hundreds of individuals and families navigate their financial journeys with clarity and confidence. His precision, empathy, and real-world insights make him a cornerstone of the Nobias leadership team.

FAQs

-

Nobias Artha, a SEBI registered advisor, is a financial wellbeing platform designed to help individuals and families in India make smarter money decisions. We combine financial education, personalized planning tools, and unbiased guidance to help you manage money better, reduce stress, and achieve your life goals.

-

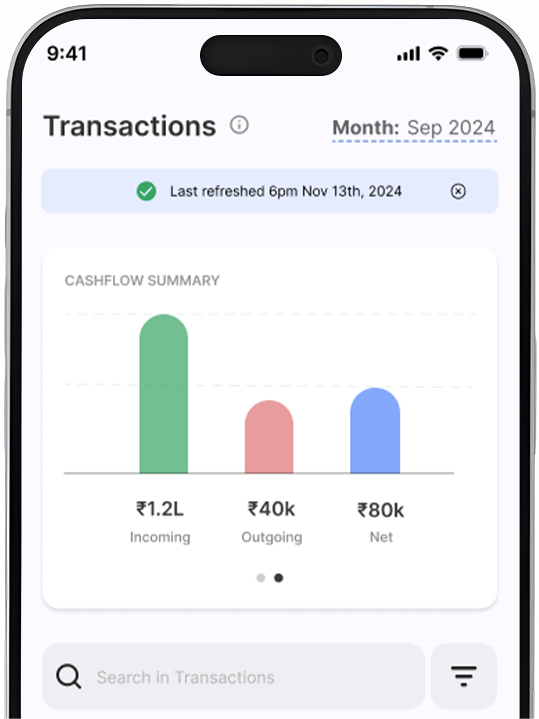

Budgeting apps show you charts on where you spend your money. We show you what to actually do.

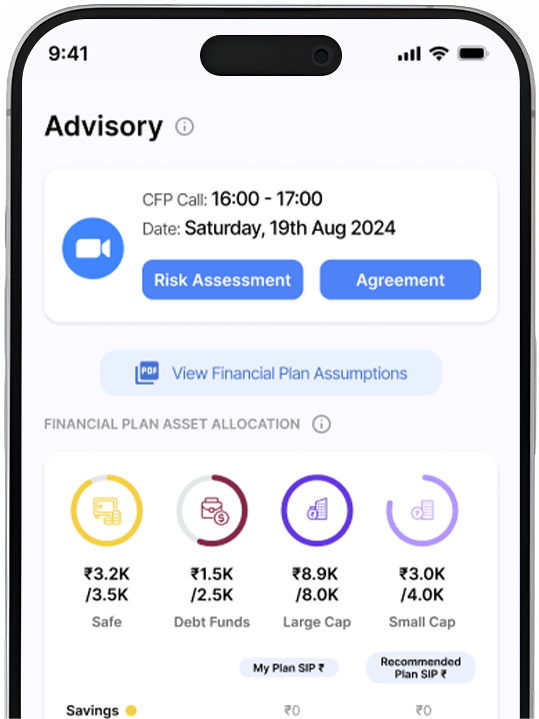

Portfolio Managers (PMs) try to beat returns of the market index with your money.Nobias is a SEBI registered investment advisor (SEBI RIA) that works with you to build a custom financial plan and invest in the market to attain your dreams - not just track expenses and not just try to beat the market.

-

Anyone who wants to stop winging it with their money.

Whether you're salaried, freelancing, or just getting started - Nobias meets you where you are and helps you build a secure future. -

You’ll sync your accounts, and start planning with Nobias, a SEBI-registered advisor.

We build your plan together - no pressure, no jargon, no bias.

-

Your money stays in your account. When you link your account to Nobias, we are provided read-only access to display information such as balances and transactions.

-

Our advisors are Certified Financial Planners with real experience helping Indians plan their money.

No bots. No product-pushing. Just people who understand EMIs, salaries, savings. and investments!

-

You can choose your preferred mode of payment, such as UPI, IMPS, NEFT, RTGS, or Cheques. If you opt to use UPI for the payment, then you have to do so only using the new validated UPI IDs. allotted to Nobias.

The secure validated UPI ID will use the same banking channel as the earlier generic UPI handle. In case of any technical difficulty, please approach your bank

How we help you take control of your money

Your financial plan is two clicks away

Join thousands of Indians who’ve stopped guessing and started planning - with Nobias.

Explore Content

-

The Real Cost of Homeownership in Major Indian Cities

In this blog, we break down the pros and cons of both options so you can make a confident and informed decision.

-

6 Traits of Financially Healthy People

Being financially healthy is about more than just having money; it’s about having control over your finances and making smart financial decisions. Financially healthy people tend to share these six traits:

-

Savings Strategies for Life: Building a Secure Financial Future

Saving money is a crucial part of financial well-being. While it may seem challenging at first, with a little effort and consistency, it can become a healthy financial habit.